Compound Interest

Compound interest is a fundamental concept in finance and a crucial tool for building long-term wealth.

It is often referred to as the "eighth wonder of the world," a quote famously attributed to Albert Einstein, who allegedly said:

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it."

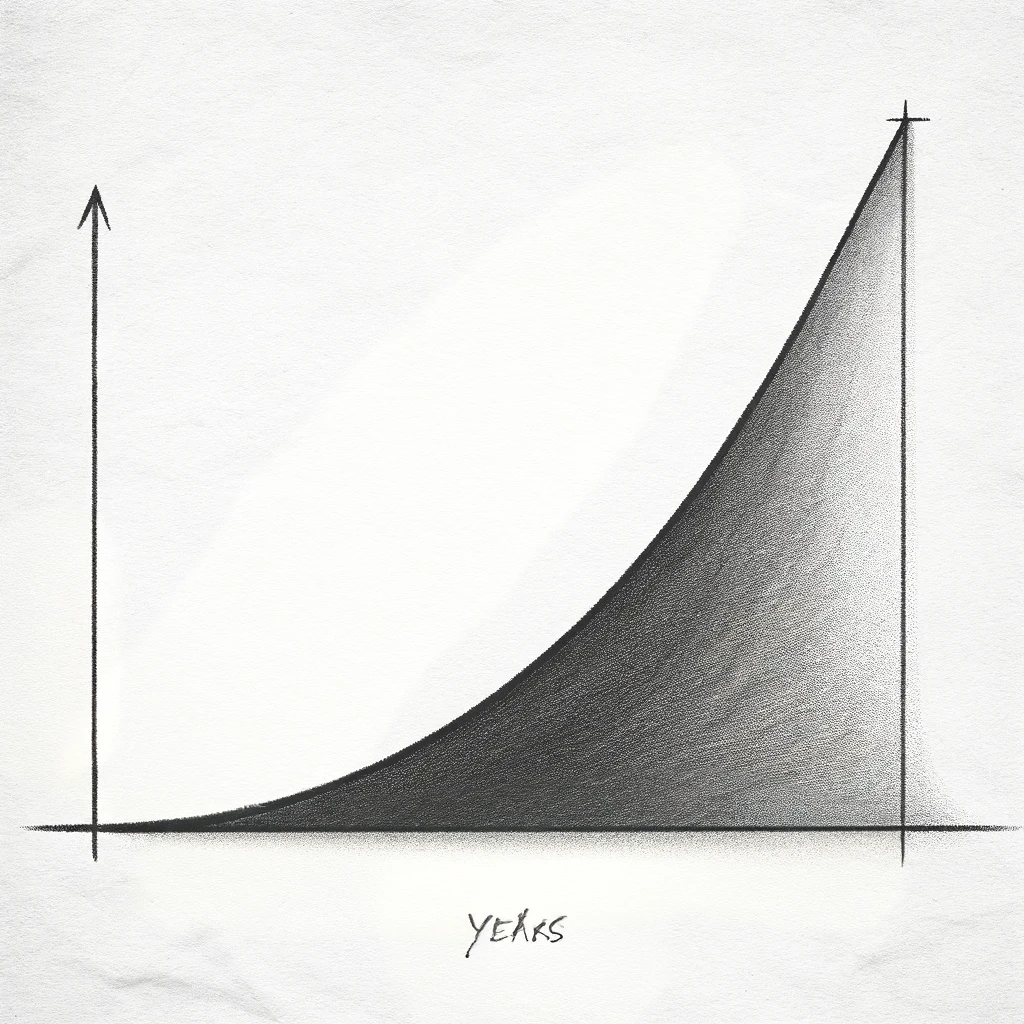

The power of compound interest lies in its ability to exponentially grow your money over time. Unlike simple interest, which is calculated solely on the principal amount, compound interest is earned on both the initial principal and the accumulated interest from previous periods. This compounding effect allows your wealth to grow at an increasingly faster rate as time progresses.

Understanding and harnessing the power of compound interest is essential for anyone seeking to build a solid financial foundation and achieve long-term financial success. Whether you are saving for retirement, a child's education, or aiming to build generational wealth, compound interest can be a powerful ally in reaching your goals.

Understanding and harnessing the power of compound interest is essential for anyone seeking to build a solid financial foundation and achieve long-term financial success. Whether you are saving for retirement, a child's education, or aiming to build generational wealth, compound interest can be a powerful ally in reaching your goals.

In this guide, we will explore the mechanics of compound interest, demonstrate its potential through illustrative examples, and provide practical strategies for maximizing its benefits in your own financial journey. By mastering the concept of compound interest and consistently applying its principles, you can unlock the door to long-term financial growth and security.

How Compound Interest Works

To understand how compound interest works, let's first explore the basic formula for calculating it. The compound interest formula is as follows:

Where:

- A is the final amount

- P is the initial principal balance

- r is the annual interest rate (expressed as a decimal)

- n is the number of times interest is compounded per year

- t is the number of years the amount is invested

Simple Interest vs. Compound Interest

To illustrate the difference between simple interest and compound interest, let's consider an example where you invest $1,000 at a 5% annual interest rate for 30 years.

Simple Interest

With simple interest, you earn interest only on the initial principal amount. The interest earned each year is constant and does not compound.

- Annual interest earned = $1,000 x 0.05 = $50

- Total interest earned over 30 years = $50 x 30 = $1,500

- Final amount after 30 years = $1,000 + $1,500 = $2,500

Compound Interest

With compound interest, you earn interest on both the initial principal and the accumulated interest from previous periods. Assuming annual compounding, your investment will grow as follows:

- Year 1: $1,000 x (1 + 0.05) = $1,050

- Year 2: $1,050 x (1 + 0.05) = $1,102.50

- Year 3: $1,102.50 x (1 + 0.05) = $1,157.63

- ...

- Year 30: $4,321.94 x (1 + 0.05) = $4,538.03